A US IP address lets you do lots of things on the web – the most important one being that you can unblock US entertainment anywhere in the world.

But how do you actually get a US IP address? That’s the difficult part, right?

Not really – there are a few online tools that let you change your IP address.

But now comes the next big question – are they free?

Some IP changing tools are free, but we don’t recommend using them. We’ll tell you why in this article.

First Things First – Which Online Tools Get You an IP Address?

To change your IP address, you need to use one of these tools:

- VPNs – Using a VPN is good way to change your IP address. It’s an online tool that routes your connections through a VPN server. Any website you visit will think your traffic is coming from the VPN server, so it will only see its IP. To get a US IP address, you need to connect to a US server.

- Proxies–Proxies work just like VPNs. They also change your IP by sending your connections through servers that sit between you and the web. But unlike a VPN, a proxy doesn’t encryption your traffic, so it can’t secure it.

We usually recommend using a VPN instead of a proxy because it’s more secure since it uses encryption. That way, it can protect you from traffic eavesdropping and MITM attacks.

Can You Get a US IP Address for Free?

Yes, you can get a US IP for free – but we really don’t recommend doing that. While there are free VPNs and proxies out there, they’re not worth it.

After all, how could an online service offer you a good experience for free? To offer US IP addresses, the service needs to rent servers in the US. Also, they need to rent servers with enough bandwidth so that people don’t deal with slow speeds. That gets expensive very fast.

We ran multiple tests with free and paid IP changers. We always had a better experience with a paid service. Here’s why:

- Free tools are always slower than paid tools because the servers don’t have enough bandwidth. In our tests, we experienced 60-70% slowdowns with free proxies and VPNs, and only 20-30% slowdowns with paid services.

- With free tools, you have to put up with monthly or daily data caps. On average, you’re limited to 500 MB or 2 GB of data each month. If you want to stream HD content on Netflix, that’s barely enough for a few episodes of your favorite TV series!

- Free proxy and VPNs might give you a US IP, but it won’t be very helpful. Streaming sites have an easy time blocking free IP changers because they don’t refresh their IP addresses very fast. So you should get used to seeing the Netflix proxy error if you use a free proxy or VPN.

- With free services, the apps you get are usually buggy and don’t work well. We had to deal with features that are non-functional, random crashes, and text that’s not aligned right.

- Free tools are usually missing important features. For example, a free VPN might not have encryption, secure and fast protocols like WireGuard and OpenVPN, or a kill switch (a feature that shuts down your Internet access if the VPN connection drops).

- Free providers don’t have the money to pay for good customer service. You either have no way of contacting the provider, or you have to deal with email support that takes very long to respond (over 72 hours). With paid services, you usually get 24/7 live chat support.

All in all, it’s obvious that free IP changers just aren’t worth it – they don’t deliver on their promises and just don’t work well.

Plus, Paid Services Aren’t That Expensive!

Not all paid IP changers cost a lot. For example, many paid VPNs have very cheap long-term plans (they cost around $2-4 per month on average).

What’s more, many paid providers have money-back guarantees (30-day refunds are the industry standard). So you basically buy with no risk!

Can You Get a US IP for Free with Tor (The Onion Router)?

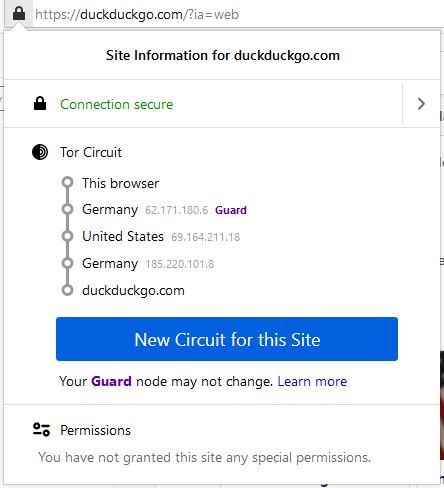

Yes, it’s possible to get a US IP free of charge if you use Tor – it’s a privacy network that hides your IP and is free to use. You just have to download and install the Tor browser (which is free) to use it.

But using Tor to change your IP isn’t very straightforward. Unlike a VPN or proxy, you don’t just pick a server location from a list and call it a day. Instead, you need to keep refreshing the Tor connection until the exit server (the last server your traffic passes through) is from the US. Sometimes, we were lucky enough to get a US exit server on the first try. But, other times, it took us 10+ tries to do that.

And that’s not the only issue with Tor – it’s also extremely slow. When we ran tests, we saw 80-90% slowdowns (even bigger than our slowdowns with free proxies and VPNs). The slowdowns are so big because:

- Tor encrypts your traffic at least three times. That makes your data very heavy, and it takes longer to transport it to its destination.

- Tor doesn’t have enough servers to meet its user base’s demand. Right now, there are around 6,000+ servers and over two million Tor users, so people struggle to get the bandwidth they need.

All in all, if you want a US IP to unblock content, Tor isn’t a good solution – stick with a VPN instead.

The Bottom Line

Using a free service to get a US IP address is just not worth it. It’s much better to use a paid tool – the speeds are faster, there are no data limits, and you can actually unblock streaming services.

How do you feel about free vs. paid IP changers? Please let us know in the comments.